1. Introduction

- Brief Overview of Swiggy's Business Journey

Swiggy has come a long way since it started. It began as a small food delivery company and has now grown into one of the biggest food delivery platforms in India. Swiggy's journey has been full of growth, new ideas, and reaching new cities to deliver food quickly to customers.

As Swiggy got bigger, more and more people started showing interest in investing in the company. This means that many investors are excited about Swiggy's IPO (when the company sells shares to the public for the first time). People believe that Swiggy will keep growing and become even more successful in the future. That's why there is a lot of excitement around its IPO!

2. Swiggy IPO Overview

Swiggy's IPO means that the company is offering its shares for sale to the public for the first time. This IPO had two parts:

Swiggy introduced 11.54 crore new shares, worth a total of ₹4,499.00 crore. This is like when a company decides to make more shares to get more money from people who want to invest.

There was also an offer for sale of 17.51 crore shares, which amounted to ₹6,828.43 crore. This is when some existing shares are sold by the current owners to new buyers.

After this IPO, the people who started and originally owned Swiggy (called promoters) will now own 52.97% of the company instead of 63.56% that they had before. This means they are sharing more ownership of the company with new investors.

What is an IPO and Why is Swiggy Going Public?

What is an IPO?

An IPO, or Initial Public Offering, is when a private company sells its shares to the public for the very first time. This is often called "going public." Imagine a company deciding to let anyone buy small parts, or shares, of its business so they can raise money to grow even more.

Why Companies Do an IPO

When a company like Swiggy decides to go public, it means it wants to raise money from people who are interested in investing in their business. This extra money can help the company make better products and reach more customers. When a well-known company goes public, it can also become more popular because more people start noticing it.

Advantages of an IPO

Here are some cool benefits for companies that go public:

- No Need to Pay Back: Unlike borrowing a loan, companies don’t have to return the money raised through an IPO.

- No Interest to Pay: Companies don’t have to pay any interest on this money, unlike when they take a loan.

- Selling Shares: Investors who already have shares in the company can sell their shares to the public when the company goes public.

- Strict Rules for Safety: Companies have to follow strict rules when they go public, which helps prevent any cheating or fraud.

Swiggy's IPO and Its Impact

Swiggy, which is a big name in food delivery, is preparing to sell its shares to the public through an IPO. This is a big deal because Swiggy’s IPO will create around ₹9,000 crore worth of wealth for its employees who have Employee Stock Ownership Plans (ESOPs). This means Swiggy's employees, both past and present, who own shares in the company, can earn a lot of money. It’s one of the biggest events of its kind in India’s startup world!

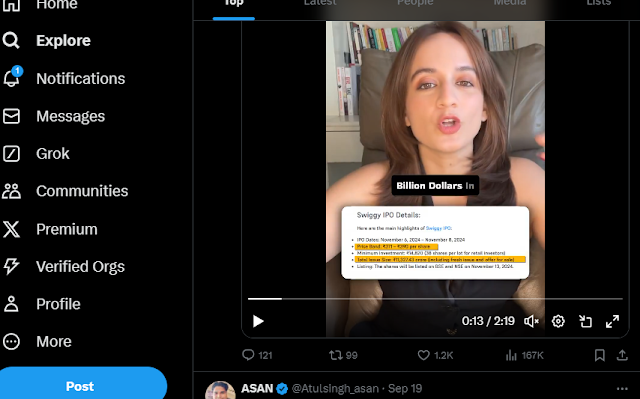

3. Key Swiggy IPO Details

Swiggy IPO Date and Expected Launch- Swiggy IPO Date 2024 | Swiggy IPO Expected Date | Swiggy IPO Launch Date

Akriti Mehrotra, Research Analyst, StoxBox. Swiggy is scheduled to launch its shares on the stock market on November 13, 2024. It has achieved a subscription rate of 3.59 times, indicating a reasonable level of investor interest.

- Swiggy IPO Price and Price Band Swiggy IPO Price

- Swiggy IPO Price Band

- Swiggy IPO Expected Price

Swiggy's shares started trading on the BSE (Bombay Stock Exchange) at ₹412, which is 5.64% higher than the original IPO price. Swiggy’s Initial Public Offering (IPO) was worth ₹11,327.43 crore and people could buy shares from November 6 to November 8. The shares were priced between ₹371 and ₹390 per share for this sale. This means people who bought shares got to own a small part of Swiggy at these prices!

4. Grey Market Premium (GMP) of Swiggy IPO |

- Swiggy IPO GMP

- What is GMP?

5. Important Documents and Regulations

- Swiggy IPO DRHP (Draft Red Herring Prospectus)

- Role of SEBI in Swiggy IPO

- Swiggy IPO SEBI Approval and Regulations

Swiggy, the big food tech company, shared an important document called the Draft Red Herring Prospectus (DRHP) with SEBI (Securities and Exchange Board of India) on September 26. This document talks about how Swiggy plans to raise money. They want to raise ₹3,750 crore by issuing new shares. There will also be a sale of 18.53 crore shares, where some of the current investors like Accel, Coatue, Alpha Wave, Elevation, Norwest, and Tencent will sell part of their shares. This helps make room for new investors who believe Swiggy will grow big in the future.

If shares are sold for about ₹350 each, the total money raised from selling these shares will be around ₹6,500 crore. This is part of Swiggy’s plan to grow in a huge food delivery market that could be worth ₹2 lakh crore by 2030. Right now, Swiggy and Zomato are the two main companies in this market, controlling more than 90% of it!

6. Key Metrics and Sizes

- Swiggy IPO Size

Swiggy's Rs 11,327 crore IPO (about $1.4 billion) is the second largest public issue to hit the local markets

- Swiggy IPO Share Price Expectations

Swiggy has decided to set the price for its IPO between ₹371 and ₹390 for each share, with each share having a face value of ₹1. If the shares are sold at the higher price of ₹390, Swiggy's total value will be about $11.3 billion. This means the company could be worth a lot of money once the IPO happens!

7. Swiggy IPO News and Updates

8. Swiggy Share Price Information Post-IPO

- Swiggy Share Price on NSE and BSE

Swiggy's shares started trading at ₹420 on the NSE, which is 7.69% more than the original price of ₹390. On the BSE, the shares opened at ₹412, which is 5.64% more than the issue price.

9. Historical and Projected Share Price Trends

- Swiggy Share Price Target 2025

In 2025, Swiggy's share price could go up because the company will likely do some smart things after going public. They will work on expanding their delivery services, reaching new areas, and making their delivery process more efficient. All of this could help Swiggy earn more money and become better at managing its business.

Investors might feel more confident as Swiggy shows that it is improving and using new technology. Based on our analysis, Swiggy's share price in 2025 could be around ₹450 to ₹600.

10. Conclusion

Swiggy’s IPO is a big moment for the company because it is now letting people buy shares in the company for the very first time. By selling these shares, Swiggy is raising money to grow even bigger and better. This means more people can own a small part of Swiggy, and the company will have more money to improve its services and expand its business.

This IPO also gives Swiggy’s employees a chance to make money from the shares they already own. Although not everyone rushed to buy shares at the start, many people are still excited about what Swiggy can do in the future.

As Swiggy focuses on reaching more places, making deliveries faster, and using new technology, the company’s value might go up, which could be good for the people who bought shares. So, if you’re following Swiggy’s journey, you’ll want to keep an eye on how the company does in the next few years. It could become even bigger and more successful!

13. FAQs

- Common Questions Related to Swiggy IPO and Share Price

- "What is the current Swiggy IPO GMP?"

- Swiggy's shares started getting ready to be sold to the public, the "grey market premium" (GMP) has been pretty small. This means people aren’t paying much extra for Swiggy’s shares before they are officially listed on the stock market. The shares were only trading about Re 1 higher than the highest price of ₹390, which means the extra amount people are willing to pay is just 0.26%. This shows that not many people are rushing to buy Swiggy's shares before they are officially available on the stock market.

- "When is the Swiggy IPO Date?"

- Swiggy's IPO share listing on the National Stock Exchange (NSE) and the BSE will take place on Wednesday, November 13, at 10 a.m.

- "What is the expected Swiggy IPO Price?"

- Swiggy's big IPO, worth ₹11,327.43 crore, was open for people to buy shares from November 6 to November 8. The price of each share was between ₹371 and ₹390, so people could buy a small part of Swiggy at these prices during the IPO.

.png)

.jpg)